In modern port operations, two colossal machines dominate container handling: Rubber-Tyred Gantry (RTG) cranes and Ship-to-Shore (STS) cranes. These engineering marvels form the backbone of global trade, efficiently moving millions of containers annually between vessels and land transportation networks. As we approach 2025, port operators face increasingly complex decisions when selecting the right equipment for their facilities. This comprehensive guide will dissect every critical aspect of RTG and STS cranes, providing port planners, terminal operators, and logistics managers with the knowledge needed to make informed investment decisions.

The global container handling equipment market is projected to reach $18.7 billion by 2025, growing at a CAGR of 4.3%, according to recent industry reports. This growth is driven by expanding international trade, vessel upsizing trends, and the pressing need for operational efficiency. Understanding the fundamental differences between RTG and STS cranes is essential for optimizing port infrastructure investments. We’ll explore their structural designs, operational capabilities, cost structures, and emerging technological innovations that are reshaping port operations worldwide.

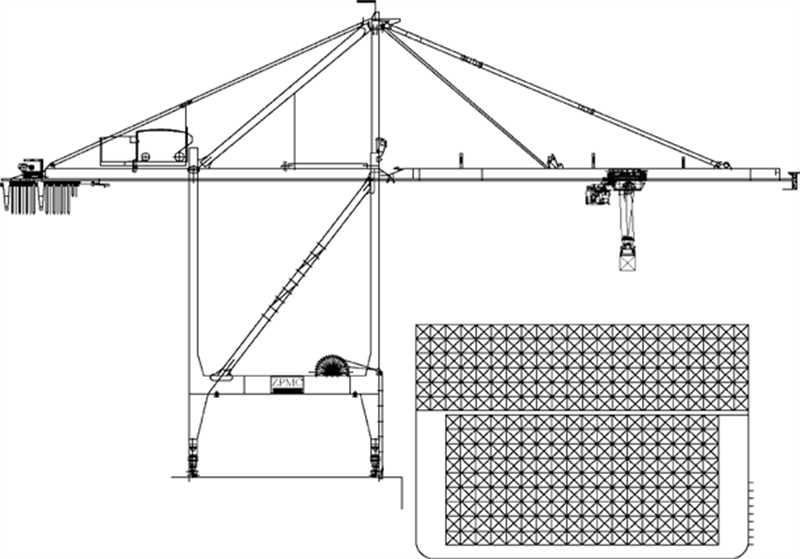

The most striking difference between RTG and STS cranes lies in their physical configuration and mobility. STS cranes are the towering giants of port infrastructure, permanently installed on rails along the quayside. These massive structures typically stand 80-120 meters tall (when booms are raised) with outreach capabilities spanning 20-24 rows of containers on today’s ultra-large container vessels. Their fixed position allows direct vessel loading/unloading but limits operational flexibility.

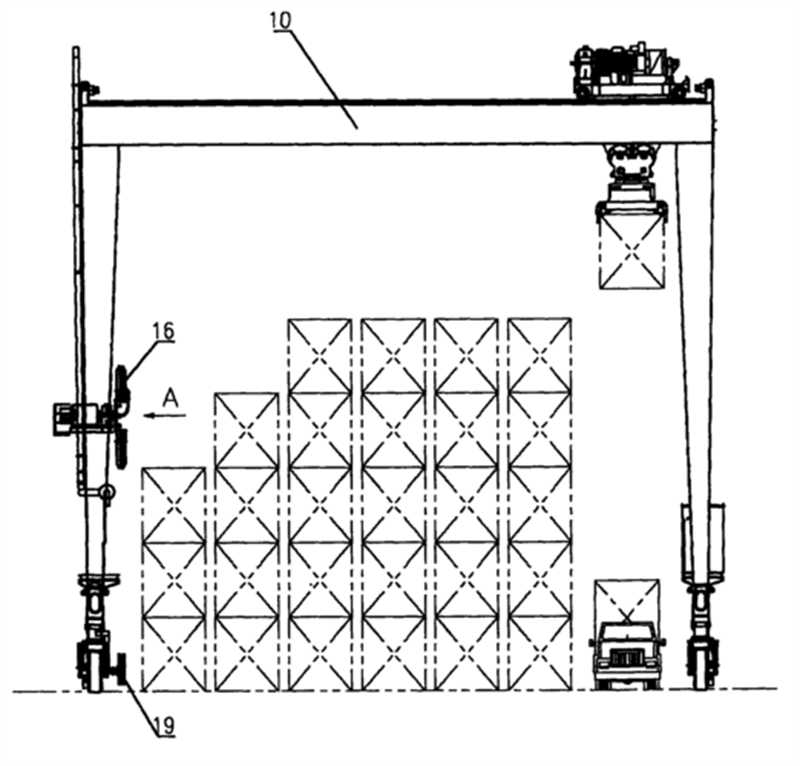

RTG cranes, in contrast, are the mobile workhorses of container yards. Mounted on rubber tires, these cranes can move freely between container stacks, typically handling 1-over-5 or 1-over-6 container arrangements. Modern RTGs feature 8-wheel or 16-wheel configurations, with the latter providing enhanced stability for taller stacking operations. Their mobility comes at the cost of lifting capacity – while STS cranes routinely handle 50-100 ton loads, RTGs typically max out at 40-50 tons.

Operational ranges differ significantly between these crane types. STS cranes specialize in horizontal movement across vessel beams, with:

RTG cranes excel in vertical stacking operations with:

The operational sweet spot for STS cranes is direct vessel interface, achieving 25-40 moves per hour under optimal conditions. RTGs typically manage 15-25 moves per hour in yard operations but can service multiple vessels through yard organization.

Power systems represent another key differentiator. Modern STS cranes are predominantly electric, drawing power from port grid systems or alternative energy sources:

RTG cranes historically relied on diesel generators but are transitioning to:

Environmental considerations increasingly favor electric RTG and STS models, with ports like Los Angeles and Rotterdam implementing strict emissions standards that phase out diesel equipment by 2030.

The financial investment required for these crane types differs dramatically. A single STS crane represents a major capital project, with 2025 pricing estimated at:

RTG cranes offer significantly lower entry costs:

Lifetime operational costs reveal different financial profiles:

STS Cranes (25-year lifespan)

RTG Cranes (15-year lifespan)

Productivity differences significantly impact return on investment:

| Metric | STS Crane | RTG Crane |

|---|---|---|

| Moves/hour | 30-45 | 18-28 |

| Containers/lifetime | 1.8-2.4 million | 600,000-900,000 |

| Cost per move | $2.50-$3.80 | $3.20-$5.00 |

| Payback period | 8-12 years | 5-8 years |

These metrics demonstrate that while STS cranes require greater upfront investment, their superior productivity provides better long-term economics for high-volume ports.

STS cranes prove indispensable in these scenarios:

RTG solutions shine in these conditions:

Emerging operational models combine both technologies:

Both crane types are undergoing rapid technological transformation:

STS Automation Advances

RTG Smart Technologies

Environmental pressures are driving green technology adoption:

STS Eco-Innovations

RTG Green Solutions

Both crane types benefit from Industry 4.0 integration:

Based on current trends and technological trajectories:

For Greenfield Projects

For Brownfield Upgrades

For Regional Ports

The RTG vs STS decision remains one of the most consequential choices in port planning. As we move through 2025, the convergence of automation, alternative energy, and digitalization is transforming both technologies. While STS cranes continue to dominate high-volume hub ports, innovative RTG solutions are becoming increasingly sophisticated for regional and specialized applications. The most successful ports will be those that strategically match equipment choices to their specific operational profiles, growth trajectories, and sustainability goals. By understanding the comprehensive comparison presented in this guide, port operators can make investment decisions that will serve their needs well into the 2030s.

Contact our crane specialists

Send us a message and we will get back to you as soon as possible.